Thesis

21 June 2023

Thesis

21 June 2023

This post was first published on our newsletter tioga.substack.com. Subscribe to get notified.

If software is eating the world, crypto is eating capital markets.

Tokenisation is not a new concept. Startups, banks, and stock exchanges have explored this since before 2017. However, the present moment is an unparalleled opportunity for mass adoption. With stablecoins proving themselves effective as a medium of exchange and DeFi infrastructure proving reliable post-DeFi Summer 2020, we stand at the precipice of a significant on-chain influx of Real World Assets.

“RWA” in the Web3 realm refers to “real world assets” — tokenised equity, debt, real estate, etc. Not to be confused with “RWA” in traditional finance, representing “risk-weighted assets”.

In fact, stablecoins now have 0.7% (~$130B) market share of the US M1 money supply1 ($18.6T) with a peak market share of ~1.0%. As a comparison, Tesla currently has 0.63% market share2 of the US car market.

DeFi on the other hand, has surged from a mere $0.6B in total value locked (TVL) in 2020 to ~$50B today, marking a staggering 80x growth. This impressive performance outstrips the 8x increase in the price of ETH.

In the midst of the market chaos in 2022, while centralised finance (CeFi) platforms such as FTX, Celsius, BlockFi, and Voyager Digital failed, DeFi stood resilient. DeFi protocols – including Aave, Compound, Uniswap, and MakerDAO – functioned flawlessly 24/7. DeFi worked great.

Hence, we are ready to usher in an era of TradFi assets on-chain.

Our thesis is three-pronged.

In TradFi, getting an equity-backed loan is a lengthy and arduous process that involves many parties. It starts with your equity custodian sending PDFs to the bank to verify you own your assets in their siloed database. Then, a bank underwrites your loan, and the custodian transfers your equity to the bank, and you receive a cash transfer. Finally, the loan terms are manually evaluated to check for any breaches. This all happens over a few days.

These high operational requirements and costs means it’s usually only practical for banks to offer such services to high net worth clients.

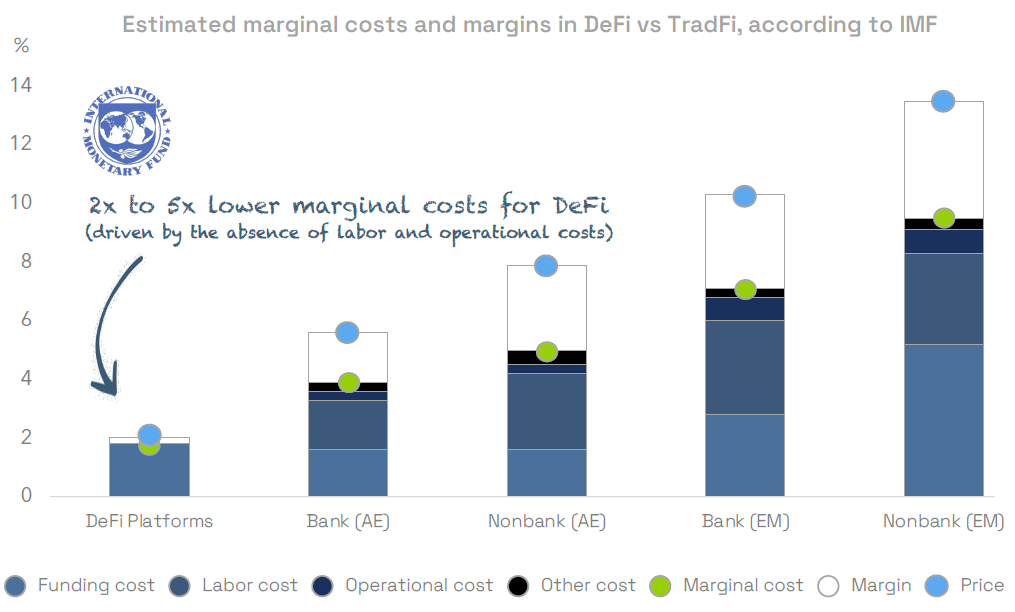

More generally, the IMF estimates that DeFi platforms have ~2X lower marginal costs compared to Banks and Non-banks in Advanced Economies, and ~4-5X lower marginal costs compared to Emerging Markets.

In Real World DeFi, this is done in a few seconds.

You press a few buttons and your equity tokens are cryptographically verified on a public blockchain then collateralised via a smart contract, where it settles instantly. You instantly receive digital cash (stablecoins) and loan terms are enforced by code.

It goes beyond that. In a world where one controls all their tokenised assets (fiat, equity, real estate, art, etc.) through their wallets, this would unlock a diversified set of potential collateral, improved liquidity through global and 24/7 trading, automated portfolio management, and much more.

As an example, PV01 (a Tioga portfolio company) is working on on-chain issuance of tokenised bearer bonds. These bearer bonds will be natively composable on the blockchain and users will be able to collateralise them easily.

From an entrepreneur’s standpoint, DeFi allows developers to access a global customer base from Day 1. Entrepreneurs can also tap into existing DeFi infrastructure, which essentially functions as a natively open API3. The low switching costs for customers fosters competition among entrepreneurs, leading to the development of the best possible products.

It intrigues us that as interest rates rose, ING’s profits increased almost 4X as they continued paying depositors 0.75% while Euro government bonds were yielding 3.4%. Yet, this is a massively profitable business for ING due to high switching costs. Banks are sticky, and have a tendency to only offer the best rates to their high net worth clients.

DeFi proposes an alternative where you can switch from one service to the other in just one click, without any discrimination. Moreover, DeFi makes a clear distinction between cash (no credit risk) and savings accounts, such that private losses from excessive risk-taking by banks won’t have to be socialised afterwards.

Now, anyone can start their own private credit fund due to efficiency gains of running it on-chain through DeFi apps such as Maple or Atlendis (Tioga portfolio company).

These back-end cost savings may be small for incumbents like BlackRock (35% operating margins) who already have economies of scale, but emerging private credit funds can tap into DeFi infrastructure4 to double operating margins from ~20% to 35-40%.

To paraphrase Jeff Bezos: “TradFi’s margins are DeFi’s opportunity.”

If you’re an Argentinian who wants to hold USD due to the rapidly depreciating Argentinian Peso, you do not need to wait for your bank to “support USD” or allow you to buy USD at the “official rate5”. You can simply receive any tokenised currency, such as USDC, into your wallet directly.

Banks and brokerages can no longer act as gatekeepers to financial products, as consumers are no longer siloed in their systems. Instead, they can tap into the universe of tokenised financial products and make their own decisions.

Real World DeFi allows you to shop for the best rates across DeFi due to its native composability and universal verifiability of assets. This is in stark contrast to being forced to open accounts with each bank with a siloed system, just to take out a loan or buy a financial product.

Now, anyone with access to the internet can have access to any financial product.

Self-custody is an insurance against counterparty risk. While self-custody is still intimidating now, Account Abstraction, Social Recovery and hybrid recovery methods will make the experience no different from current bank log-ins.

During Silicon Valley Bank’s bank run (the same with Lehman Brothers in 2008), there was close to zero transparency. No one really knew if they were solvent and risk couldn’t be monitored, let alone externally verified.

Now, if SVB were to run on-chain, we would have full transparency of their assets and liabilities, being able to create Dune dashboards to “watch the chain”. We would also be able to monitor the liquidity through risk management suites such as Chaos Labs (a Tioga portfolio company).

The Terra collapse was a great example of this. There was a bank run on Anchor Protocol driven by the downward price of Luna. While we were left in the dark during Lehman Brother’s collapse in 2008, we had minute-by-minute transparency on-chain, and retail users would have equal access to this information as with institutions to make optimal decisions.

But, where are we now on the adoption curve?

At the beginning of 2020 DeFi TVL was ~$600M, after which it ballooned to +$150B. Currently it stagnates around $50B.

Where DeFi was in 2020, is where on-chain Real World Assets are today. It currently sits at an all time high of $600M in TVL6, with $340M coming from private credit and $260M from on-chain T-bills.

DeFi was able to take-off due to an unique combination: a flood of liquidity after the COVID stimuli checks, people having time to experiment when COVID struck, and new crypto primitives (e.g., AMMs, yield farming) ready for alpha usage.

We believe that with $50B in TVL today, we now have robust proof points how DeFi can be a blueprint for the next paradigm shift of the financial industry.

The steady growth in RWA Credit was uncorrelated with the rise and fall of crypto prices showing how blockchain technology need not be purely for speculation, but can simply be used as a technology to transfer value. Hence the term “internet of money” – for the first time, we are able to transfer self-sovereign value through the internet.

Centrifuge was the pioneer of RWA as they worked closely with MakerDAO since 2020 to fund RWA credit in trade finance, structured credit products, revenue-based financing, and EM credit, among others. Goldfinch and Credix mainly focus on EM credit across LATAM, Africa and Southeast Asia.

Meanwhile, many other credit protocols have also launched with a focus on African and Southeast Asian credit, such as Atlendis (a Tioga portfolio company), Bluejay Finance and Jia.

Starting in early 2023, tokenised T-bills emerged as another trending asset class.

Several T-bill protocols launched in H1 2023, including Ondo Finance, Matrixdock, Backed Finance, Swarm Markets, Franklin Templeton’s Benji app, OpenEden, and Maple’s cash management pool.

T-bills have been experiencing strong tailwinds as ~$135B of on-chain stablecoin capital is potentially looking for a way to access TradFi risk-free rates without the cumbersome off-ramping processes.

One might question the rationale behind using tokenised T-bills – if I were a HNWI, wouldn’t I just buy T-bills through a traditional brokerage?

The answer lies in two subtle distinctions.

Firstly, tokenised T-bills cater not to the ordinary user, but to high-net-worth individuals (HNWI), traders, or hedge funds who prefer to avoid the friction costs of off-ramping from the on-chain world to the off-chain world.

Tokenised T-bills are also beneficial for DAOs and startup treasuries, particularly those outside the US, and DeFi protocols that require permissionless composability of RWA assets.

As an example, Ribbon Finance just made a $2M order of Backed’s tokenised T-bills to use the generated yield to purchase ETH options. On the other hand, Angle Protocol is working on getting a proposal passed to have Backed tokens as collateral for their Euro-stablecoin.

Secondly, to many incumbents, T-bills serve as a go-to-market strategy due to the current rates arbitrage between DeFi and CeFi. They demonstrate the feasibility of tokenised assets on-chain, both from a technical and legal standpoint.

In essence, tokenised T-bills could be the trojan horse to bring traditional bonds and other financial assets on-chain.

The Real World DeFi space is still in its infancy, yet the signs of early product-market fit are starting to be visible.

We see adoption starting from on-chain capital (crypto-natives, non-US crypto companies, the unbanked) seeking low risk yields (T-bills), then moving up the risk curve (trade financing, bonds, private credit).

Soon after, we expect adoption from TradFi capital attracted by the features uniquely enabled by blockchain technology, such as borrowing against your full tokenised asset base, better liquidity and capital management, and new investment products (bond issuances). Lastly, institutions will come for the efficiencies and to offer these blockchain-enabled services to their client base.

It is still early days for Real World DeFi. Besides tokenising real world assets, there is much to improve on blockchain scalability, privacy, and security before we can reach the inflection point for DeFi adoption.

If you are building in Web3 and planning to change the world, feel free to reach out to us at pitch@tioga.capital.

Footnotes:

Note that we exclude crypto market makers from RWA lending.

Atlendis labs raises $4.4 million seed round to bring uncollateralized crypto loans to defi backed by Lemniscap Parafi capital Tioga capital and others

08 December 2021

Atlendis, a capital-efficient DeFi lending protocol that will soon enable uncollateralized crypto loans, has closed a seed funding round of $4.4 million from leading crypto venture capital firms. The round was led […]