Company

05 April 2023

Company

05 April 2023

This post was first published on our newsletter tioga.substack.com. Subscribe to get notified.

The long-established fixed income market, with its $215 trillion in outstanding debt, is in dire need of modernization. Currently, it confronts a myriad of obstacles, including limited accessibility, insufficient transparency, and a complex bond-selling process that contrasts sharply with the simplicity of retail stock purchases.

Furthermore, as highlighted by Bloomberg, investors’ capacity to effortlessly transition to cash-equivalent securities, such as short-term government bonds and money market funds, has become an urgent issue as concerns persist over banks’ resilience to deposit outflows and record-high inflation.

In the crypto market particularly, the existing mosaic of one-to-one loans has led to significant failures due to the accumulation of risk among a few market players (e.g., FTX, Three Arrows Capital, Celsius), leading to a need for increased transparency of debt ownership.

PV01 aims to revolutionize the bond market with its mission to build and operate debt capital markets where a healthy digital asset ecosystem can thrive, and to become the “Robinhood of bonds”.

The company’s platform streamlines the traditional due diligence and underwriting process for the primary market, while offering a seamless secondary market through real-time transfers and state-of-the-art dealing systems. By tokenizing bonds on the blockchain, PV01 provides several key advantages, including increased transparency across the debt value chain, more efficient issuance and distribution through smart contract automation and shared ledgers, deeper liquidity and accessibility via global access and asset fractionalization, automated coupon payments, and reducing counterparty risk through instant settlement.

The timing is perfect for PV01’s innovative solution, as blockchain infrastructures are now ready to fulfill one of their true visions: providing provable digital ownership and transferability. According to BCG, there will be $800B in tokenized bonds by 2030, and 76% of corporates and investors recognize the added-value of tokenization. On the crypto-native side of the spectrum, we already see protocols and stablecoins looking into on-chain treasuries that generate yield in a transparent, secure, and efficient way through platforms like PV01, instead of the only ‘black-box’ alternatives they could previously use (i.e. the centralized lending platforms that went bankrupt).

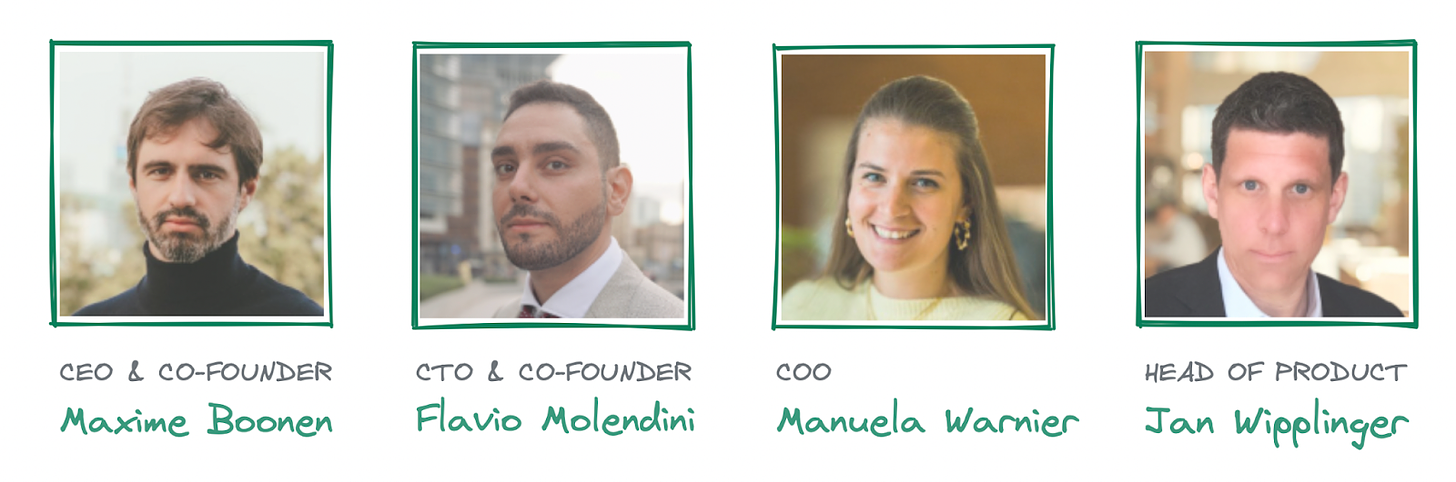

The PV01 team includes specialists from both traditional finance (TradFi) and decentralized finance (DeFi), assembling the necessary skills to shape the future of debt markets. This extraordinary team fuses time-honored capital markets understanding with top-tier digital asset proficiency, essential for disrupting the industry.

In 2015, PV01’s founders Maxime Boonen and Flavio Molendini created B2C2, today’s leading digital asset OTC platform, which was acquired by Japan’s SBI in 2020. This demonstrates the team’s proven track record of achievement within the digital asset domain. Before establishing B2C2, Maxime Boonen held the position of interest rates trader at Goldman Sachs. Meanwhile, Flavio Molendini worked on the creation of trading systems.

If you are an institution looking to issue blockchain-based bonds or if you are looking for investments in high-quality debt products, we welcome you to reach out to us (deal@tioga.capital) and we’ll make a warm intro to our friends at PV01.

Atlendis labs raises $4.4 million seed round to bring uncollateralized crypto loans to defi backed by Lemniscap Parafi capital Tioga capital and others

08 December 2021

Atlendis, a capital-efficient DeFi lending protocol that will soon enable uncollateralized crypto loans, has closed a seed funding round of $4.4 million from leading crypto venture capital firms. The round was led […]