about us

Our team commits to helping founders. Above and beyond.

Tioga Capital’s focal point is on backing Europe’s most exceptional and astute Web3 entrepreneurs.

Read moreOur beliefs

Individual Sovereignty

We invest in the great awakening of the sovereign individual and the potential of peer to peer distributed networks to reshape the nature of reality.

Data Ownership

In Web2 data was “the new oil” – in Web3 data is open and abundant, allowing developers and creators to break up the Web2 data monopolies.

Open Finance

Permissionless blockchains allow for interoperability and give developers and users alike access to financial products at a global scale, from day one.

Privacy

True sovereignty comes with privacy, a fundamental human right to protect the minority from the majority.

about us

Our team commits to helping founders. Above and beyond.

Tioga Capital’s focal point is on backing Europe’s most exceptional and astute Web3 entrepreneurs.

Read more We’re lucky enough to partner with

category defining companies & protocols.

Nym is the privacy infrastructure of the Internet. NYM is a distributed, worldwide, decentralized incentivized mixnet.

Personally I find a European hands-on & long-term focused blockchain venture capitalist, which is independent of Silicon Valley, a must have in a token round. Tioga fits this mold perfectly for Nym. We’ve had many insightful conversations on structuring the tokenomics, as well as on the go to market strategy and the token launch game plan (e.g. which market makers to work with, which platform to use etc.)

Harry Halpin – NYM

Read moreNym is the privacy infrastructure of the Internet. NYM is a distributed, worldwide, decentralized incentivized mixnet. NYM tokens are issued by nodes providing mixing resources to the network.

investment mandate

At Tioga we focus on being the best European long-term partner to exceptional Web3 entrepreneurs.

Infrastructure & Open Finance

Equity and Crypto Assets

€500K – €5M ticket size

Europe

5+ year investment horizon

NEWS

Subscribe to our newsletter here

Why We Invested in Altitude

28 January 2024

Overcollateralised lending is one of the most prominent use cases of DeFi, especially during bull markets when the demand for leverage increases. However, despite the programmability and composability of DeFi, we are still struggling with a trade-off between capital efficiency and peace of mind when taking over collateralized loan positions.

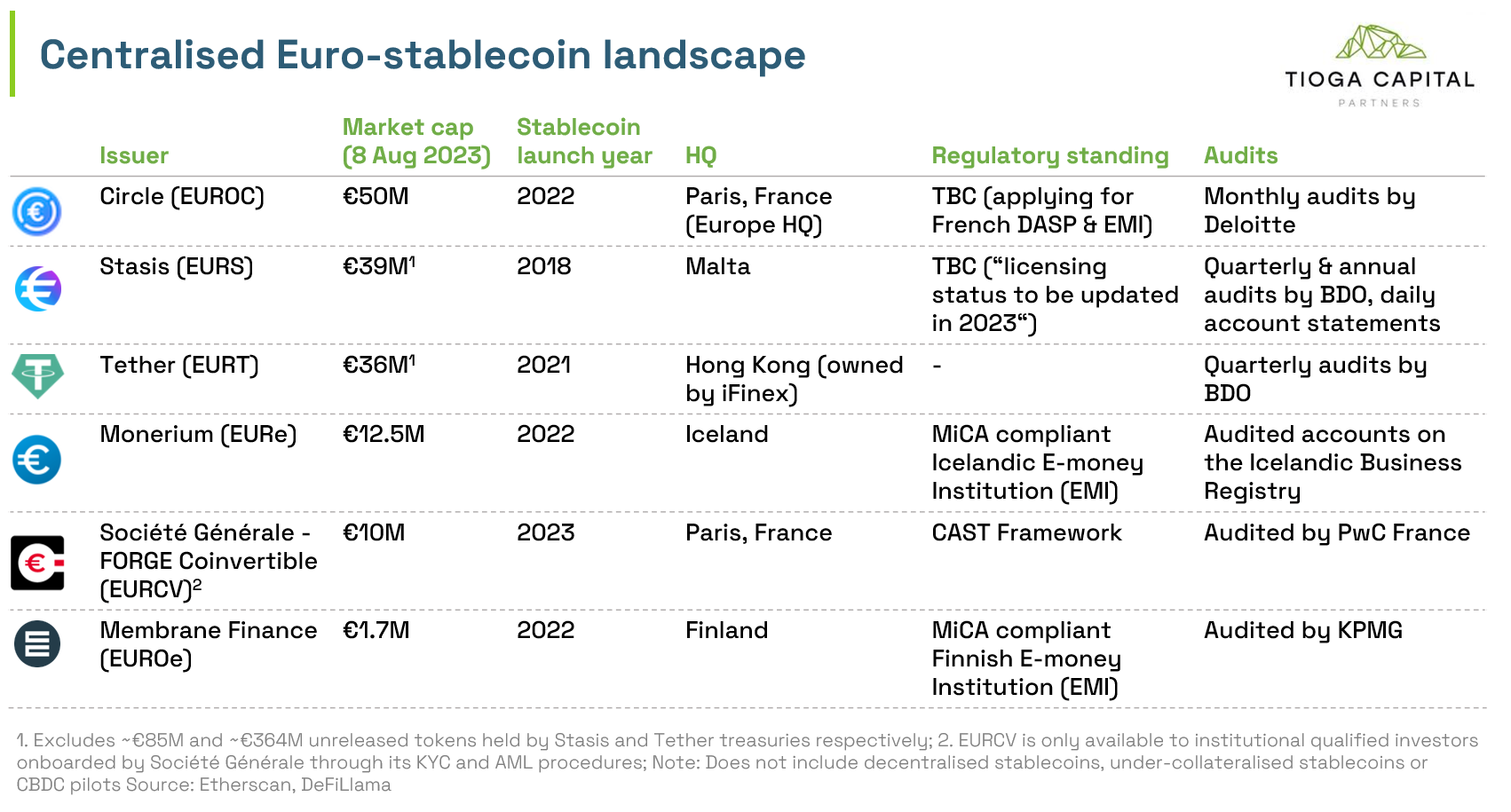

Euro stablecoins and the Future of Money

09 August 2023

In Q1 2023, Blackrock made $1.16B in net income. In that same time, Tether netted $1.48B. A stablecoin issuer has just surpassed the net income of a 35-year-old asset manager with $9T AUM.

It is no surprise that issuing stablecoins is a highly profitable business, at least for now.

Thesis: Real World DeFi

21 June 2023

If software is eating the world, crypto is eating capital markets.

Tokenisation is not a new concept. Startups, banks, and stock exchanges have explored this since before 2017. However, the present moment is an unparalleled opportunity for mass adoption. With stablecoins proving themselves effective as a medium of exchange and DeFi infrastructure proving reliable post-DeFi Summer 2020, we stand at the precipice of a significant on-chain influx of Real World Assets.