This post was first published on our newsletter tioga.substack.com. Subscribe to get notified.

In Q1 2023, Blackrock made $1.16B in net income. In that same time, Tether netted $1.48B. A stablecoin issuer has just surpassed the net income of a 35-year-old asset manager with $9T AUM.

It is no surprise that issuing stablecoins is a highly profitable business, at least for now.1

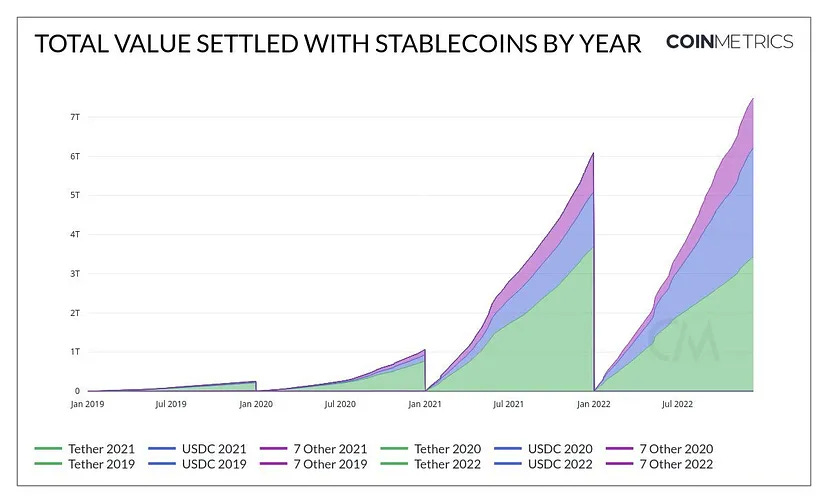

In fact, $7.4T of stablecoins have settled on-chain in the bear market of 2022. This notably excludes the trillions that get settled on centralised exchanges. As a comparison2, Visa and Mastercard settled $12T and $8.2T respectively in 2022.

It’s about time cash went through a 0-to-1 upgrade into programmable, internet-native digital dollars which can be moved instantly, 24/7.

Stablecoins can be used for digital payments, which is a $2.5T market globally. In fact, most existing digital payments companies are already preparing for stablecoin payments.

Both Visa and Mastercard support USDC settlements. Stripe now allows USDC payments starting with Twitter. Checkout.com gives 24/7 liquidity with stablecoin settlement, and Paypal just launched their own stablecoin, $PYUSD, this month.

The risk of Fintech’s main business – transactions – becoming obsolete is very real, as consumers can now send digital cash in a peer-to-peer fashion without any intermediaries.

If crypto wants to go mainstream, it will become the FinTech back-end.

Here’s a quick primer on stablecoins. Let’s use Circle as an example. Whenever you give Circle $1 in fiat, they store it at a traditional finance institution (e.g., bank) and give you 1 USDC. When you want to get your $1 in fiat back, you give Circle the USDC, they “burn” the token and remove it from circulation and transfer $1 from their fiat reserves to you.

Currently, Circle has issued 26.0B of USDC, and has $26.1B of reserves. Of this $26.1B, $1.8B is held in reserve banks for liquidity purposes (to meet redemption demand) and $24.3B is held in a portfolio3 of short-dated T-bills and US Repos.

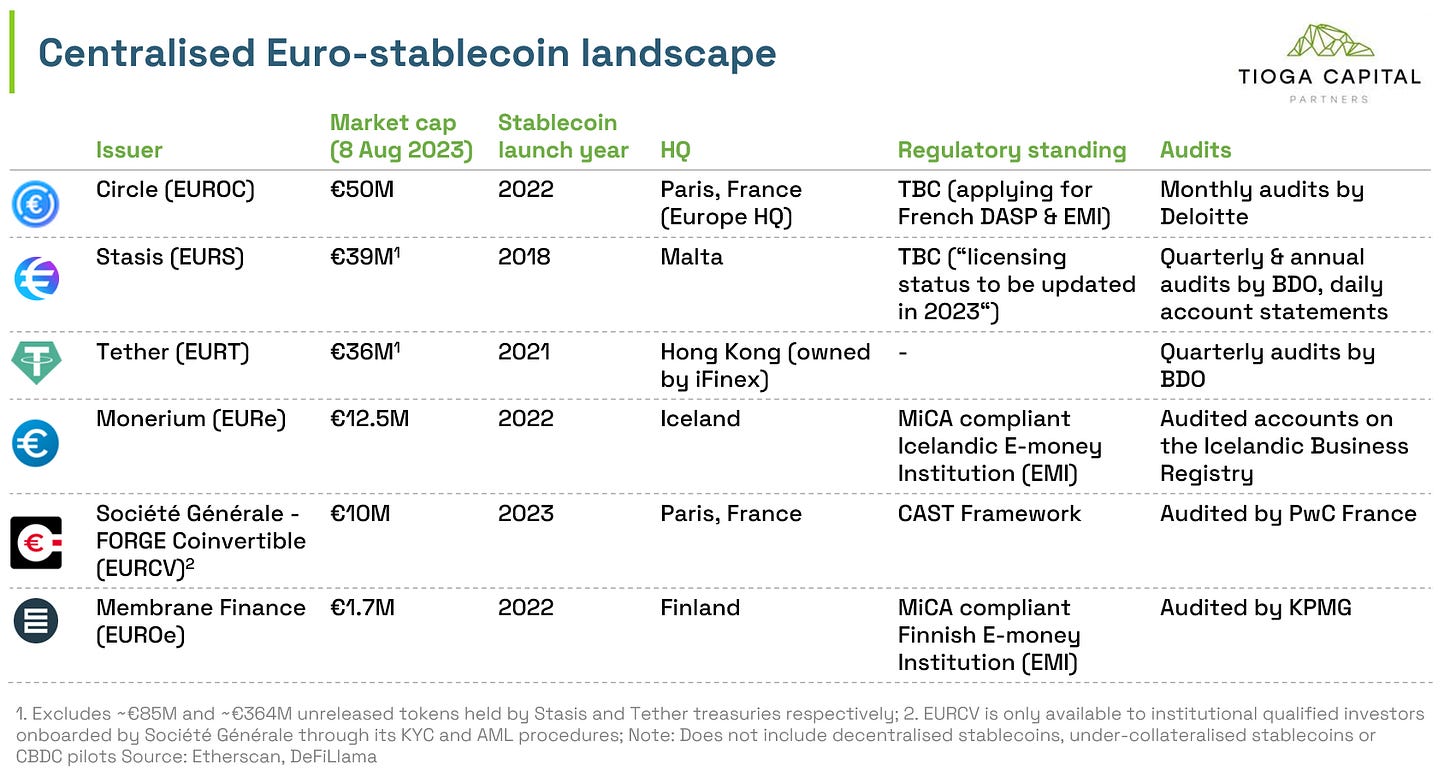

The interesting part of the status quo is that although centralised stablecoins have a combined market cap of ~$120B, USD stablecoins represent 99.8% of this.

There is a clear dislocation in the market as Euros are the second most used currency in the world. For international payments via SWIFT, USD has a 45% share while Euro has 35%. In terms of FX trading, this is 44% USD vs 16% EUR. The USD market should be 1.3-2.8 times larger than Euros, not 477 times larger.

To put this into perspective, if Euro Stablecoins was as big as in traditional markets4 (50% of USD market), we’d be looking at a $60B existing market capitalisation with $2.1B of untapped revenue opportunity when invested in EU government bonds5.

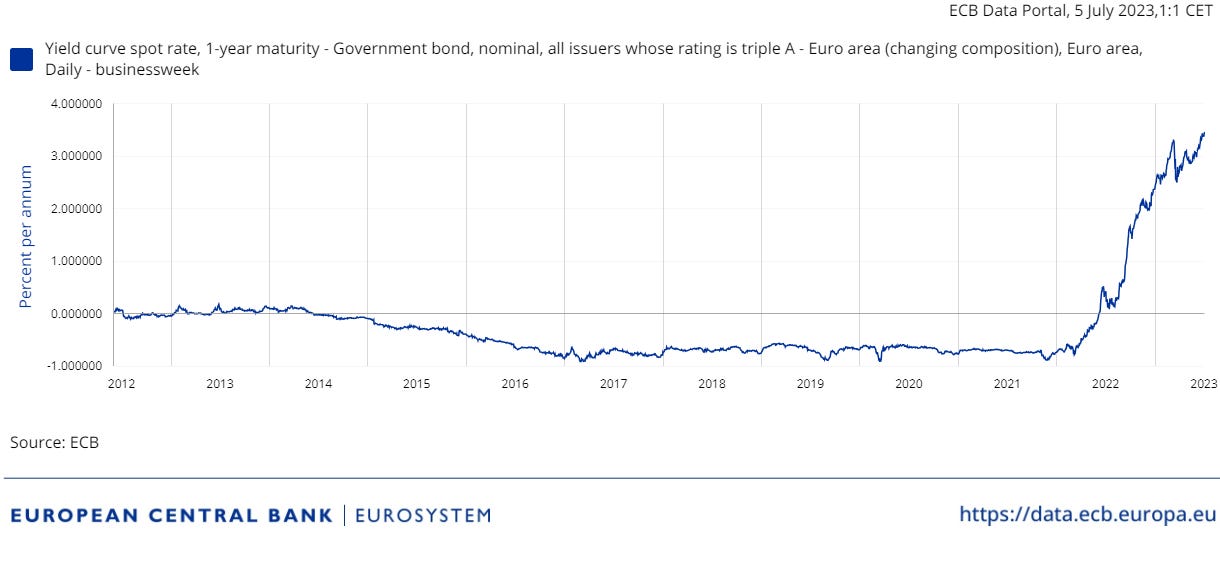

The business model of a stablecoin issuer at its inception tends to be through T-bills or government bonds. While Circle and Tether were able to generate positive returns on their USD reserves, this was not the case with Euros where government bonds were generating negative returns. It was only until mid-2022 where yields turned positive.

The business model makes sense now.

Existing Euro stablecoin solutions were also sub-par compared to US counterparts. The leading stablecoins issued by Circle (EUROC) and Tether (EURT) are currently not MiCA compliant. They will have until 30th June 2024 to comply. Given the issuance from outside the EU, EUROC cannot solicit customers outside the US, ruling out usage by EU retail customers, exchanges, banks, and custodians.

With MiCA, there is now a clear regulatory framework for stablecoins, referred to as “e-money tokens”. Stablecoin issuers will need an E-Money Institution (EMI) licence and be regulated the same way as EMI Fintechs, such as Wise and Stripe.

Silvergate’s Euro SEN was a key enabler for Circle’s launch of EUROC as it provided the banking rails and 24/7 redemptions. Since Silvergate’s liquidation after the collapse of FTX, EUROC has been cut off from traditional finance networks. One of the very few known alternatives is Europe’s BCB Group which launched BLINC, Europe’s first 24/7 instant settlement network6 which could support instant issuance and redemption of a Euro stablecoin.

There exists a huge opportunity for incumbent banks to create an efficient banking network to move stablecoin collateral.

At first sight, US incumbents (e.g., Circle) are likely facing the innovator’s dilemma. Given the lower rates in Europe (~3.5%) as compared to the US (~5%), US stablecoin issuers do not have a strong incentive to promote Euro stablecoin liquidity vs the USD liquidity they already have. However, given the regulatory uncertainty in the US and clarity in the EU, they might de-risk themselves by turning to Europe, as evidenced by Circle establishing their HQ in Paris.

On the demand side, stablecoins’ primary use case has been for trading crypto. Our hypothesis is that given the volatility of crypto is much higher compared to USD/EUR volatility, FX risk is not a priority and thus traders are happy to use USD stablecoins.

However, we see potential for a stronger demand for a Euro stablecoin in the near future.

The Euro stablecoin is fundamental infrastructure for Euro-centric Real World DeFi.

Euro-denominated Real World DeFi (which we wrote about here) needs a blockchain-native Euro to purchase Euro-denominated financial products without FX risk, such as bonds issued by Obligate (which has partnered with Membrane Finance to settle in EUROe stablecoins) or PV01 (a Tioga portfolio company).

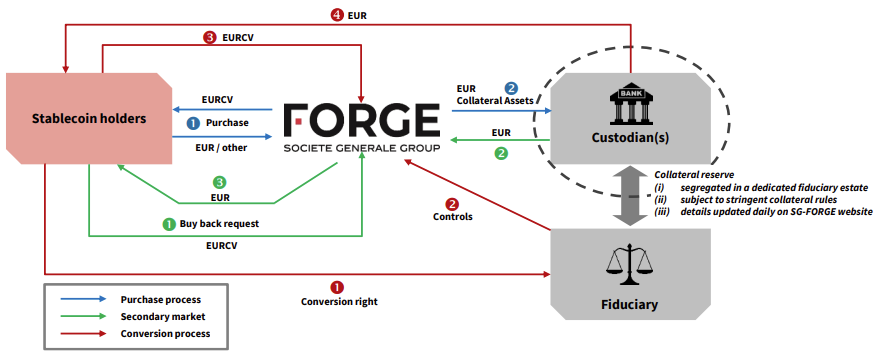

This is further evidenced by the launch of Societe Generale-FORGE’s (SG-FORGE) Euro-stablecoin, EURCV, on Ethereum earlier this year. SG-FORGE’s main goal is to bridge the gap between traditional capital markets and the digital assets ecosystem, particularly using EURCV a “robust settlement asset for on-chain transactions”.

This is crucial as SG-FORGE issues debt instruments such as structured products and bonds on public blockchains including Ethereum and Tezos.

EURCV is only available to institutional qualified investors onboarded by Societe Generale through its KYC and AML procedures. However, its token contract is publicly auditable on the Ethereum blockchain.

A Euro stablecoin also opens up the possibility of European companies raising private debt without FX risks through platforms such as Maple or Atlendis (a Tioga portfolio company). The growth of the Euro stablecoin would be intimately linked to the growth of a Euro-centric Real World DeFi ecosystem.

Over a longer time horizon, we also see Euro stablecoins being used for payments through instant on-chain settlement. There are strong market tailwinds here with MiCA regulating Euro stablecoins as “e-money tokens” and blockchain scaling solutions making on-chain transactions much cheaper.

As other non-USD stablecoins emerge, cross-border remittances and a fully on-chain Foreign Exchange (FX) will have a stronger value proposition as it bypasses the SWIFT system and allows a cheaper and more efficient FX experience. Euro-denominated crypto trading could also potentially become a use case, but will take a much longer time to bootstrap Euro liquidity here.

We stand at an interesting point in time where there are numerous catalysts to bolster the business case of a Euro stablecoin, all while real world use cases are starting to gain traction.

This makes it an interesting opportunity for start-ups in the space to use the current high interest rate environment to their advantage to bootstrap sufficient liquidity and integrate deeply into the crypto ecosystem. The regulatory clarity around Euro stablecoins due to MiCA provides significant tailwinds for adoption, as compared to US regulators who are much further behind.

Founders in this sector should pay particular attention to competition against a well-capitalised competitor (Circle), vertically integrating a strong use case for your stablecoin (e.g., Circle’s partnership with Coinbase via Centre at its inception) to building sufficient liquidity, and potential regulatory uncertainty around the issuance of tokenised deposits from commercial banks or a CBDC / Digital Euro (which might not be based on blockchain tech).

If you are building a Euro stablecoin, crypto-banking product or any stablecoin use cases, feel free to reach out to us at pitch@tioga.capital.

Footnotes: