This post was first published on our newsletter tioga.substack.com. Subscribe to get notified.

Overcollateralised lending is one of the most prominent use cases of DeFi, especially during bull markets when the demand for leverage increases. However, despite the programmability and composability of DeFi, we are still struggling with a trade-off between capital efficiency and peace of mind when taking over collateralized loan positions.

Achieving capital efficiency demands a minimal collateral ratio, thus reducing idle assets. Yet, this approach requires constant vigilance to avoid liquidation.

On the flip side, opting for a more worry-free borrowing experience involves maintaining a high collateral ratio. While this reduces the frequency of monitoring, it comes at the cost of lower capital efficiency.

This is where Altitude comes in.

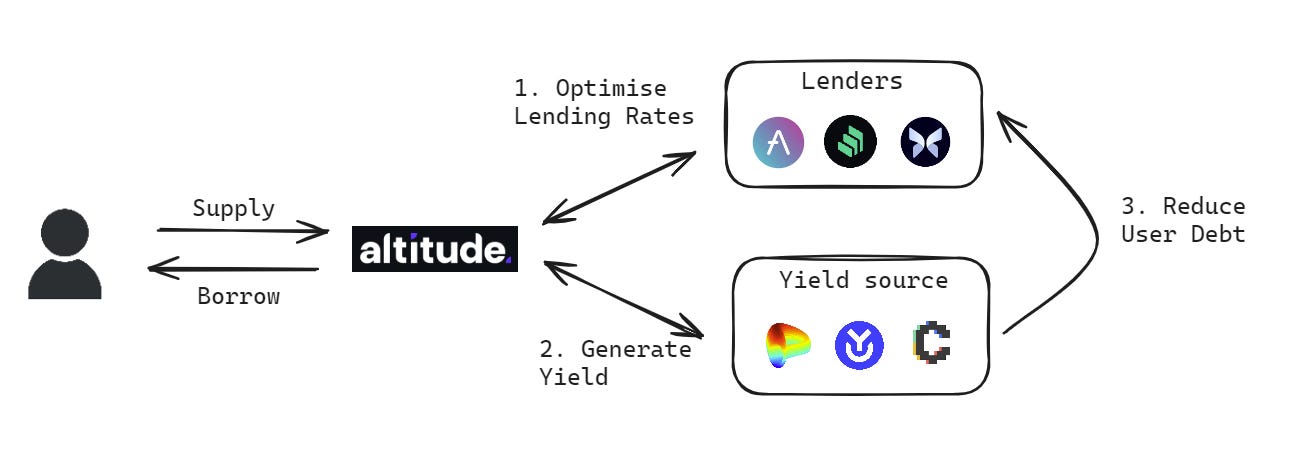

Altitude addresses this trade-off with an innovative solution. The protocol actively manages collateral ratios and invests idle collateral, ensuring a safe margin while generating yield to mitigate borrowing costs. In certain scenarios, it can even lead to self-repaying loans when the generated yield surpasses the interest cost.

Furthermore, Altitude monitors loan dynamics and actively refinances loans on protocols such as Aave and Compound. This active refinancing allows Altitude to secure the lowest borrowing rates, reducing the cost of debt and freeing borrowers from the ongoing task of loan optimisation.

For a more detailed breakdown of the protocol, see Altitude’s Medium post here.

In a bull market where demand for leverage is high, market participants will naturally seek over collateralized loans. However, it is also these markets that tend to be the most volatile with multiple pullbacks before making greater highs. As we’ve seen in early January, Bitcoin plummeted by ~10% in a matter of hours, likely triggered by an analyst report of a potential BTC ETF rejection, compounded with a “leverage flush”.

Prior to the advent of Altitude, users were required to set up alerts and possibly awaken during odd hours to adjust their loan positions, given the 24/7 nature of crypto markets.

With the introduction of Altitude, the process of managing positions is fully automated, ensuring a healthy loan-to-value (LTV) ratio to prevent liquidations. Additionally, Altitude handles loan repayment, seeks refinancing at the most favourable rates, and automatically compounds yields, all seamlessly.

Altitude co-founders, Tobias, Ronald, and Ivailo, have been in the crypto space since before DeFi. Like many of us, they have experienced the frustrations of managing their crypto portfolio in a capital-efficient manner, especially during volatile markets. Determined to address these frustrations, they took matters into their own hands and built a product for all DeFi users.

We are proud to lead the Altitude’s $4M Seed along with New Form Capital, GSR, Owl Ventures, UDHC, Soft Holdings, MetaVision VC, Flow Ventures and over 50 amazing Web3 builders.

Owing to the team’s deep connections in crypto, Altitude has also raised a $2.1M Pre-Seed from over 50 strategic Web3 founders and builders including Yoann Turpin (Wintermute), Harry Grieve (Gensyn), Ahmed Al-Balaghi and Aniket Jindal (Biconomy), Tommy Quite (Merit Circle), James Parillo (Figment), Facu (Yearn Finance), Nick Tong (Perpetual Protocol), and Ramsey Khoury (Vega Protocol).

For more updates, follow Altitude on X and Discord.